by Kreitler Financial | Feb 4, 2025 | Financial Planning

Digital advancements in wealth management share a common characteristic with precision instruments – their effectiveness depends entirely on the expertise of those who wield them. While technology has revolutionized portfolio management capabilities,...

by Kreitler Financial | Jan 28, 2025 | Retirement Planning

The transition to retirement represents one of life’s most significant financial and psychological shifts, particularly for those who have spent decades building distinguished careers in academia or the private sector. Yet, even for individuals who have...

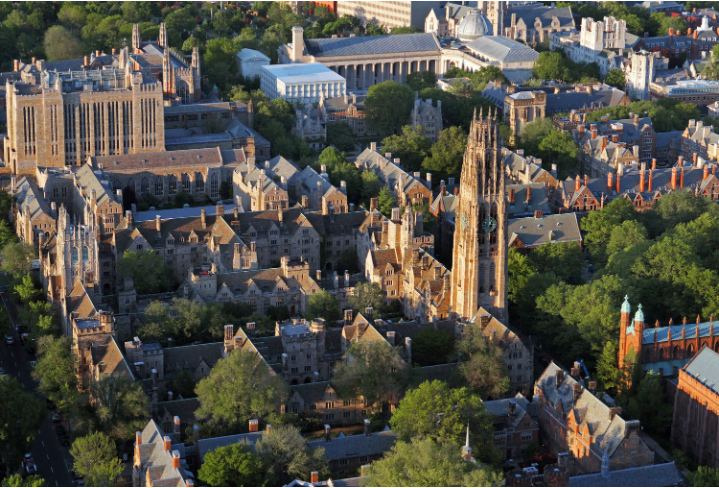

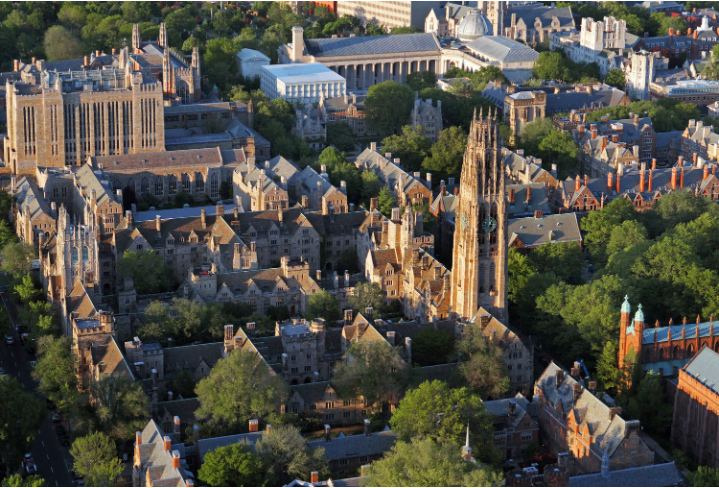

by Kreitler Financial | Nov 21, 2024 | Charlie's Corner

With the enrollment bust of 2026 right around the corner and possible suggestions of a tuition increase, the path to higher education just got even bumpier (as if it wasn’t already!) Luckily for Yale employees though (both faculty and staff) – there is good...

by Kreitler Financial | Nov 14, 2024 | Kreitler Financial News

As a Yale employee, ensuring a financially secure retirement is crucial. The introduction of the Self-Directed Brokerage Account (SDBA) within Yale’s retirement plan offers a significant opportunity to tailor your investments to your personal goals and values....

by Kreitler Financial | Oct 31, 2024 | Financial Planning

Financial planning for affluent households isn’t just about managing investments or minimizing taxes. It’s about orchestrating a complex symphony of financial instruments, life goals, and family dynamics to create a harmonious and prosperous future. This...