The roller-coaster ride of the last two years continues without a break. The pandemic sparked by COVID-19 and the lockdowns that followed inevitably led to record inflation and a period that, so far, investors would like to forget.

After two terrific years in the stock market, 2022 has started off with the dubious distinction of being one of the worst starts to a year for both stocks and bonds. Inflation hit a rate of 8.6% year over year in May. The bond markets have experienced a huge selloff, with the Bloomberg U.S. Aggregate Bond index down over 10% as of June 30th. Stocks reached bear market (typically defined as down 20%) territory on June 13, 2022 and are down 20.6% as of June 30th as the market reacts to rising inflation, rising interest rates, and the potential that it may take a recession to get inflation under control.

In this blog we will review the first half of 2022, explore some of the possible causes, and address how investors can manage the uncertainty we face in the coming months.

How we got here

It’s helpful to zoom out and look at the root cause of the situation. The 2020 pandemic caused panicked authorities around the world to impose lockdowns to prevent the spread of COVID-19. Fearing the economic consequences of having much of the global workforce stay home, governments around the world unleashed enormous support in the form of direct cash subsidies to individuals and companies combined with ultra-cheap interest rates and a flood of money into the system. In the US, the 10-year treasury hit an all-time low yield of 0.54% in 2020, and the government used quantitative easing to push more than $3 trillion into the economy. This set the stage for monetary inflation. Stocks soared on the flood of new cash, with the S&P doubling in value from the pandemic low in March 2020. Other assets like real estate also increased in value.

Meanwhile, lockdowns caused disruptions to the global supply chain, creating a shortage of goods at a time when consumers were holding record amounts of cash in their bank accounts. Too many dollars chasing too few goods set the stage for supply side inflation. Then, just when things seemed to be improving, as they had been before the pandemic as a result of globalization and technological innovation, Russia invaded Ukraine. The major effect of the invasion was that the taboo (in place since World War II) against taking one’s neighboring territory by force, thereby reshuffling global alignments and adding huge amounts of risk and uncertainty to the markets, was broken. Energy and food prices soared around the world as supply again fell below demand.

Inflation eats away at the value of your wealth in a variety of ways:

- The value of cash savings declines in purchasing power.

- Anyone on a fixed income finds the dollar stretches a little less far.

- Families are forced to shift their spending as gasoline and grocery bills rise.

The Federal Reserve is combatting this in two ways. First, they are raising interest rates. This is the visible action they can take and makes borrowing more expensive. Second, they are removing the money they pushed into the economy during the pandemic, replacing “quantitative easing” with “quantitative tightening.” It’s important to note that the debt created by the Treasury during the pandemic’s quantitative easing process doesn’t go away. As interest rates rise, the cost of servicing that debt increases. This will be a topic for another day.

Just as cheap and plentiful money pushed asset prices up, higher interest rates and reduced monetary supply can push prices down. Fed Chairman Jerome Powell made it clear in June that they will raise interest rates to cool inflation, even if it risks a recession. The markets listened.

Market Review – YTD as of June 30, 2022

| Market Index | YTD Return |

| Bloomberg Barclays US Aggregate Bond Index | -10.35% |

| S&P 500 Composite Index | -19.96% |

| Russell 2000 Index | -23.43% |

| MSCI EAFE Index | -19.25% |

| MSCI EM (Emerging Markets) Index | -17.47% |

*Source: YCHARTS

Stock markets saw a broad-based selloff, with the biggest losers being the pandemic highfliers. Technology stocks, like Netflix and Peloton. Some of the value oriented investments we have used outperformed growth. Still, the sell-off has bee broad-based and left little places to hide within the stocks.

Increasing interest rates have caused a decline in bond prices. We have been concerned for some time about the impact of ultra-low rates and have used bonds that have a shorter maturity in client portfolios. These bonds tend to be less affected by interest rate changes, and these positions helped to mitigate some of the bond losses. The 10-year US Treasury bond’s yield has moved from 1.63% at the beginning of the year to 2.98% as of June 30th. Short term, rising rates are painful as prices drop. Longer term, savers are better compensated due to the higher interest rates going forward.

Diversification has also proven helpful. Investors normally hope that conservative investments like bonds will rise, or at least hold value, when stocks fall. Direct participation real estate fared better and was one of the few bright spots for those diversified portfolios that include it.

Investment Strategy

What should investors do? Inflation is eating the value of cash. Stock market volatility remains high, and bonds have disappointed.

Bear markets are a normal, if unpleasant, part of investing. In challenging times, investors need to focus on their long-term strategy. The rational course for investors is to have a strategy that allows you to hold assets that can beat inflation over the long term, even though those assets have higher volatility. Holding these riskier assets requires you to hold enough ‘safer’ assets like cash or government bonds to meet liquidity needs, even in tough times and even if the cost of holding these assets is that they may not hold their purchasing power if their return is less than future inflation.

Unfortunately, we can’t know whether the worst has passed or there is more to come. Much hinges on whether inflation begins to cool, allowing the Fed to slow interest rate increases. The war in Ukraine remains a significant variable. The Fed could trigger a recession, and while stock prices have come down they are still based on fairly optimistic forecasts of growing corporate profits. For investors with far-off horizons and strong stomachs, this may be a buying opportunity. Our sense is that markets have priced in much of the negative news, but this could play out for some time to come.

Risk management is something that should be done in advance of bad markets, using a portfolio strategy that attempts to weather the inevitable market downturns investors face. A good investment strategy must recognize that the future is unknowable, yet we need to be able to meet goals during both good and bad periods. Those who are compelled to sell in the middle of a bear market risk turning temporary volatility into a permanent loss.

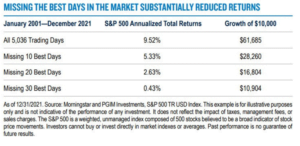

Often the markets’ best days come in the early days of a recovery. Missing them can be painful, as illustrated by this chart from PGIM Investments. Investors need to be willing to stay invested to get the markets’ long term returns.

Hang in there. We encourage you to speak with us if you have questions about your particular situation.